Ensure your clients properly protect what's most important to them with our repackaged Home Insurance.

Our newly enhanced policy provides even more cushioning for those unexpected events.

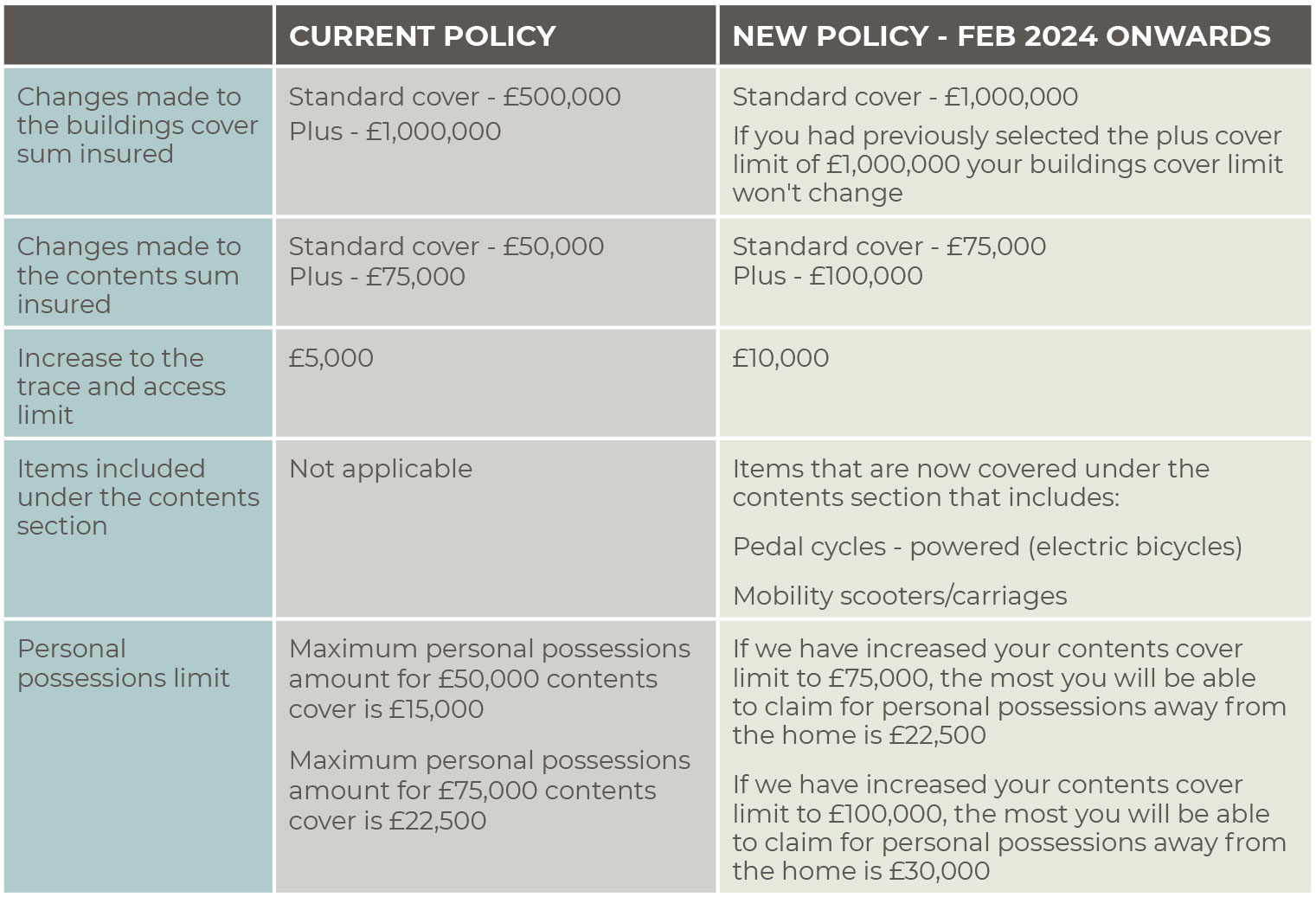

What's changed?

Our new Home Insurance brings an increased level of protection for your clients and better reflects current market conditions.

The table below highlights some of the key changes that have been made, including an increase in 'Standard' cover for both buildings and contents. The left hand side describes the part of the policy that has changed, the middle column shows the cover limits of the previous policy, and the final column shows the current cover limits of the new policy.

Delve into the detail

For the full list of updates to the policy, you can download the Table of Changes.

Existing quotes and pending policies

Whether you've already given your client a quote, or you know they're due for renewal, here's some helpful information including important dates you need to be aware of;

Pending policies will be valid until 30 April

All pending policies will expire on midnight 30 April, if not submitted by this date.

Once the quote has expired, if a client wants to proceed with their policy, you'll need to go into Adviser Hub and re-quote from the beginning. They will then be quoted on the new policy and its limits.

Existing quotes will be valid until 30 April

Any exiting quotes you have for your clients, will expire on midnight 30 April, if not submitted by this date. It’s recommend that you check with any impacted clients in good time to see if they want to proceed with the policy.

What happens if you need to make any amends to a quote?

If you need to make any amends to your client’s policy from Monday 19 February, such as increased policy limits, purchasing any optional extras or adding on any specified items, then your client will be re-quoted on the updated Paymentshield Home Insurance policy.

Renewals

Existing customers with a Paymentshield policy underwritten by our panel of insurers will automatically receive a Table of Changes within their renewal pack s as they approach their renewal period and will be invited to download a copy of the new Policy Booklet from the Paymentshield website.

Your clients can also now find out more information regarding renewals on our dedicated page designed to help make the process as easy as possible.

Watch our Home Insurance webinar

We look at the recent changes to the product, as well as how to make the most out of the GI selling opportunity in our Home Insurance webinar.

We also show how soft skills such as effective questioning can help you have better conversations with your clients.

Updated resources

Below are resources for you and your clients that have been updated to reflect the new Home Insurance product

Home Insurance customer leaflet

To share with your clients to help them understand the features and benefits of our refreshed Home Insurance.

Contents Insurance customer leaflet

To share with your clients to help them understand the features and benefits of our updated Contents Insurance.

Optional extras customer leaflet

Help your clients understand the features and benefits of the optional extras available on our refreshed Home Insurance.

The specifying script eBook

Get to grips with when your clients need to specify items on their Home Insurance policy and why that conversation is important.

Brand your docs

Our customer leaflets, including our recently updated leaflets for Home Insurance, are available for you to co-brand with your business logo placed alongside Paymentshield's. As well as your logo you can also add your contact details to the end of the leaflets.

You can also brand a selection of our posters and guides in the same way.

GI Academy

Refresh your product knowledge with our GI Academy Home Insurance module. Each chapter in the module has been updated to reflect the recent changes so that you can continue to confidently discuss our Home Insurance with your clients.

You can then head over to the test section of GI Academy to quiz yourself on your product knowledge.

Get more insights from our partner updates

.tmb-lg-thmb.jpg?Culture=en&sfvrsn=ffde3912_1)

Proud partner of Legal & General Mortgage Club

We're happy to be partnered with Legal & General Mortgage Club as part of their Referral Pro to offer their club members options for general insurance.In Partner updates

Enhanced home insurance offers greater protection for your clients

Find out more about our new and improved Home Insurance.In Partner updates

New regional sales manager for the North West

A warm welcome to the Paymentshield family, Rebecca Hocken, the new regional sales manager for the North WestIn Partner updates